Jumbo Loan: Competitive Rates and Flexible Terms for Costly Residences

Jumbo Loan: Competitive Rates and Flexible Terms for Costly Residences

Blog Article

The Effect of Jumbo Financings on Your Funding Options: What You Required to Know Before Using

Jumbo finances can play a pivotal function in forming your funding options, specifically when it comes to acquiring high-value homes. Understanding the equilibrium in between the difficulties and benefits posed by these finances is necessary for possible debtors.

Recognizing Jumbo Financings

Recognizing Jumbo Loans requires a clear understanding of their distinct qualities and needs. Jumbo financings are a type of home loan that exceeds the adjusting financing limits established by the Federal Real Estate Money Agency (FHFA) These restrictions vary by place however generally cap at $647,200 in most areas, making big car loans essential for financing higher-priced residential or commercial properties.

Among the defining functions of big car loans is that they are not qualified for purchase by Fannie Mae or Freddie Mac, which causes more stringent underwriting guidelines. Customers have to typically show a greater credit report, usually over 700, and provide substantial paperwork of revenue and assets. Furthermore, lenders may need a bigger down settlement-- frequently 20% or even more-- to minimize danger.

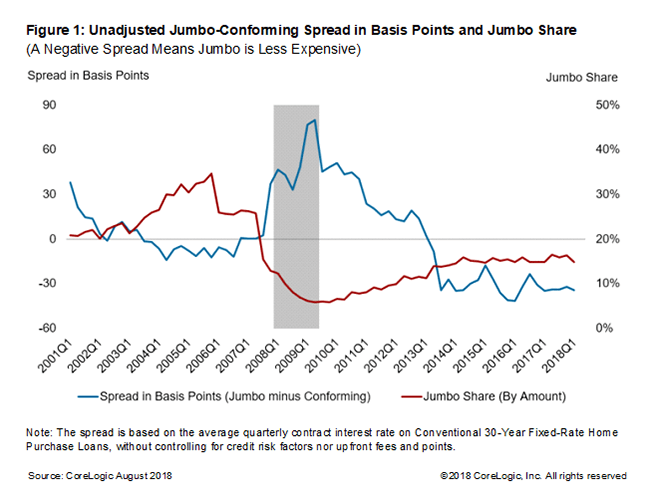

Interest rates on jumbo finances can be a little higher than those for adhering finances because of the raised danger thought by the loan provider. The lack of personal home loan insurance policy (PMI) can offset some of these expenses. Recognizing these variables is crucial for potential borrowers, as they considerably influence the terms and feasibility of securing a jumbo funding in today's competitive property market.

Advantages of Jumbo Lendings

Jumbo loans supply distinctive benefits for property buyers looking for to buy high-value residential properties that exceed traditional funding restrictions. One of the key advantages of big finances is their ability to finance larger quantities, permitting purchasers to acquire homes in costs markets without the restrictions enforced by adapting car loan limits - jumbo loan. This adaptability allows homebuyers to check out a wider variety of residential or commercial properties that may much better suit their demands and preferences

Furthermore, big fundings frequently feature competitive rates of interest, specifically for customers with strong credit profiles. This can bring about considerable financial savings over the life of the finance, making homeownership much more economical over time. Additionally, big car loans can be customized to match private monetary circumstances, using numerous terms and amortization options that line up with the debtor's goals.

Difficulties of Jumbo Fundings

Navigating the intricacies of big fundings provides several obstacles that prospective borrowers must know before proceeding. One substantial hurdle is the rigorous loaning criteria enforced by banks. Unlike adjusting fundings, jumbo finances are not backed by government-sponsored enterprises, leading lending institutions to embrace even more extensive standards. This frequently includes higher credit report demands and significant paperwork to validate income and properties (jumbo loan).

Additionally, jumbo fundings typically come with greater rate of interest prices contrasted to standard lendings. This elevated price can significantly influence monthly payments and general cost, making it crucial for customers to meticulously analyze their financial scenario. Additionally, the deposit demands for jumbo lendings can be try these out substantial, typically ranging from 10% to 20% or even more, which can be a barrier for lots of possible property owners.

Another difficulty depends on the limited accessibility of big funding items, as not all lenders provide them. This can bring about a reduced pool of choices, making it critical for consumers to carry out thorough research study and possibly seek specialized lending institutions. On the whole, comprehending these obstacles is essential for anyone considering a jumbo funding, as it makes certain enlightened decision-making and better economic planning.

Qualification Criteria

For those considering a big financing, meeting the credentials standards is a vital action in the application procedure. Unlike conventional finances, jumbo finances are not backed by federal government firms, leading to stricter demands.

First of all, a solid credit history is crucial; most lending institutions call for a minimum score of 700. A higher rating not only boosts your possibilities of approval but might also protect better rate of interest. In addition, debtors are normally expected to demonstrate a significant earnings to ensure they can easily manage greater regular monthly payments. A debt-to-income (DTI) proportion below 43% is generally preferred, with reduced ratios being extra positive.

Down repayment requirements for big lendings are also substantial. Borrowers must anticipate taking down at the very least 20% of the residential or commercial property's acquisition rate, although some loan providers might offer choices as reduced as 10%. Demonstrating cash money gets is important; loan providers frequently need evidence of adequate fluid assets to cover several months' worth of home loan settlements.

Contrasting Funding Options

When assessing financing choices for high-value websites homes, recognizing the distinctions in between numerous funding kinds is crucial. Big lendings, which surpass adapting financing limits, typically come with stricter qualifications and greater rate of interest than traditional finances. These loans are not backed by government-sponsored enterprises, which enhances the lending institution's danger and can cause much more rigid underwriting requirements.

In comparison, conventional car loans provide more adaptability and are usually much easier to acquire for debtors with solid credit report profiles. They may feature reduced interest prices and a wider variety of choices, such as taken care of or variable-rate mortgages. Furthermore, government-backed car loans, like FHA or VA lendings, provide possibilities for lower down payments and even more lax credit scores requirements, though they likewise impose limitations on the funding amounts.

Conclusion

Finally, jumbo financings existing both opportunities and difficulties for potential property buyers looking for funding for high-value buildings. While these car loans permit larger amounts without the problem of exclusive home mortgage insurance policy, they include rigid certification demands and prospective drawbacks such as higher rates of interest. A comprehensive understanding of the challenges and advantages related to big financings is essential for making informed decisions that align with long-lasting economic objectives and goals in the property market.

Report this page